The Importance of Vetting Investment Seminars and Gurus

If you’ve ever been interested in investing, chances are you’ve come across countless seminars and gurus promising to teach you the secrets to financial success. With promises of high returns and insider knowledge, these investment seminars and gurus may seem like a no-brainer. However, it’s important to take these opportunities with a grain of salt and carefully vet them before jumping in headfirst. In this article, we’ll discuss the importance of vetting investment seminars and gurus, and why it’s crucial for your financial success.

The Pitfalls of Blindly Trusting Investment Seminars and Gurus

Many of us are drawn to investment seminars and gurus because of the allure of quick and easy wealth. With flashy advertisements and charismatic speakers, it’s easy to get caught up in the hype and believe that these seminars and gurus have all the answers. However, this can be a dangerous mindset that can lead to financial ruin.

The reality is that not all investment seminars and gurus have your best interests at heart. Some may be looking to make a quick profit off of attendees, while others may be promoting risky or even fraudulent investment strategies. Blindly trusting these seminars and gurus without proper vetting can lead to disastrous consequences for your investments.

Why Vetting is Important

Protect Your Finances

Vetting investment seminars and gurus is crucial to protect your hard-earned money. By carefully researching and evaluating each opportunity, you can avoid falling prey to scams and risky investments. This not only protects your finances, but also your overall financial well-being.

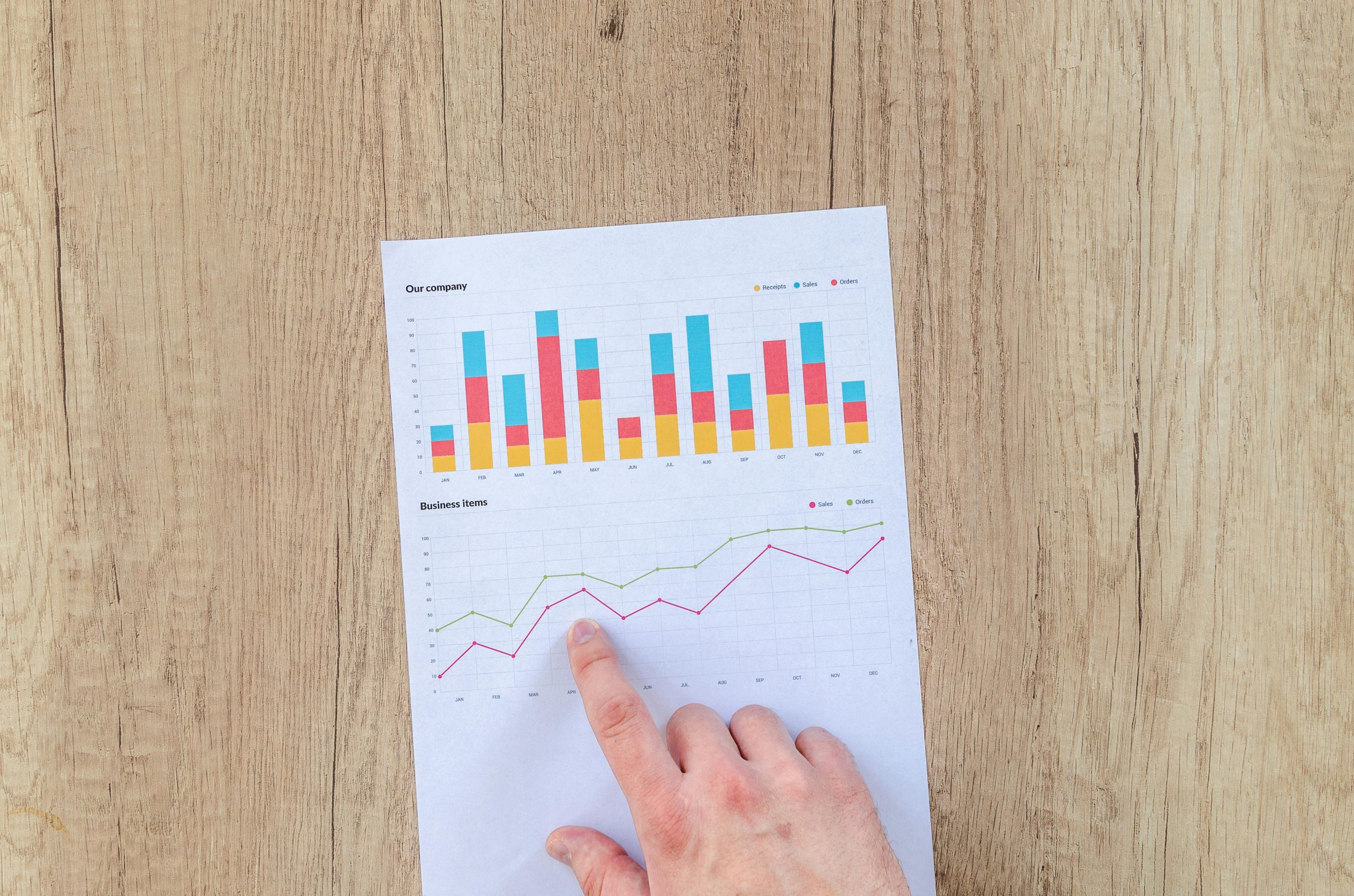

Quality of Information

It’s important to note that not all investment seminars and gurus are created equal. Some may offer valuable and accurate information, while others may be filled with misleading or false claims. Vetting allows you to ensure that the information being presented is relevant and trustworthy, so you can make informed decisions about your investments.

Avoid Overspending

Investment seminars and gurus often come with a hefty price tag. Without proper vetting, you may find yourself spending exorbitant amounts of money on information or services that are not worth their value. Vetting allows you to make an informed decision about whether the cost of the seminar or guru is worth the potential return.

How to Vet Investment Seminars and Gurus

Research the Background and Track Record

One of the first steps in vetting investment seminars and gurus is to research their background and track record. Look into their qualifications, experience, and success rate in the industry. This will give you a better understanding of their expertise and credibility.

Check for Reviews and Testimonials

Reading reviews and testimonials from previous attendees can also be helpful in determining the quality of the investment seminar or guru. Be sure to check multiple sources and look for both positive and negative feedback.

Attend a Free Seminar or Webinar

Many investment seminars and gurus offer free introductory events to entice attendees. Take advantage of these opportunities to get a feel for the information and strategies being presented. This will also give you a chance to evaluate the speaker and their teaching style.

Consult with a Financial Advisor

If you’re unsure about an investment seminar or guru, consider consulting with a financial advisor. They can provide unbiased and professional advice on whether the investment opportunity is suitable for your financial goals and risk tolerance.

In Conclusion

Vetting investment seminars and gurus is not a one-size-fits-all process. It’s important to carefully consider each opportunity and do your due diligence to ensure that you’re making informed decisions about your investments. By doing so, you can protect your finances and increase your chances of achieving financial success.