The Best Practices for Teaching College Students Finance

A college education is a valuable investment for young adults, providing them with the skills and knowledge they need to succeed in the real world. However, navigating the world of personal finance can often be daunting for college students. From student loans to credit cards, young adults are bombarded with financial decisions that can have a lasting impact on their future. As educators, it is our responsibility to equip students with the necessary tools to make sound financial decisions and set them up for long-term financial success. In this article, we will discuss the best practices for teaching college students finance. By implementing these practices, you can help your students gain a better understanding of personal finance and set them up for a bright financial future.

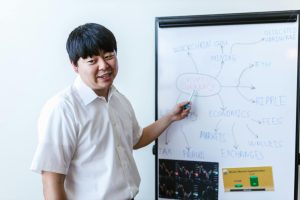

Creating a Financial Literacy Curriculum

The first step in teaching college students finance is to develop a comprehensive financial literacy curriculum. Many students enter college without a basic understanding of financial concepts such as budgeting, saving, and investing. A well-developed curriculum should cover these topics and more, providing students with the knowledge they need to make informed financial decisions.

1. Start with the Basics

Begin by teaching students the fundamentals of personal finance. This includes creating a budget, understanding credit scores, and managing debt. These are essential skills that will serve as the building blocks for more complex financial concepts.

2. Incorporate Real-Life Examples

When teaching financial literacy, it is crucial to use real-life examples to help students better understand the concepts. This could include discussing the cost of attending college, analyzing credit card statements, or creating a mock budget based on a starting salary post-graduation. By making the material relatable, students are more likely to engage and retain the information.

Utilizing Interactive Learning Methods

Traditional lectures and textbook readings can be dry and unengaging for college students. To keep students interested and actively learning about finance, it is essential to incorporate interactive learning methods into your teaching. Here are a few ideas for making financial literacy more engaging:

1. Guest Speakers

Bringing in guest speakers from various financial backgrounds can give students valuable insights into the real-world application of finance. Speakers could include financial advisors, bankers, or even former students who have successfully managed their finances after graduation.

2. Financial Simulations

A financial simulation is an interactive activity that allows students to practice making financial decisions in a risk-free environment. These simulations could include investing in stocks, managing a budget, or choosing a credit card. By participating in these activities, students can gain practical experience and apply the concepts they have learned in real life.

Encouraging Student Involvement

When it comes to learning about personal finance, getting students actively involved is crucial. Here are a few ways to encourage student involvement and make finance more relatable:

1. Group Projects

Assigning group projects that require students to work together to solve a financial problem can help develop teamwork skills and promote critical thinking. Additionally, working in groups allows students to learn from each other and share different perspectives.

2. Peer-Assisted Learning

Peer-assisted learning can also be an effective way to engage students in financial literacy. This method involves assigning students as peer mentors to help their classmates understand financial concepts they may be struggling with. It allows students to learn from their peers and reinforces their understanding of the material.

Incorporating Technology

In today’s digital age, incorporating technology into teaching is essential. Here are a few ways you can use technology to enhance financial literacy:

1. Online Calculators and Tools

There are many online calculators and tools available to help students better understand financial concepts. These tools can assist with budgeting, calculating interest rates, and even creating a debt repayment plan. Encourage students to explore these resources to supplement their learning.

2. Mobile Applications

There are also various mobile applications designed to help students manage their finances. These apps can track expenses, monitor credit scores, and even provide investing advice. Encourage students to download and explore these apps to understand how they can benefit their financial journey.

In conclusion, teaching college students finance is crucial to set them up for long-term financial success. By implementing a comprehensive financial literacy curriculum, utilizing interactive learning methods, and encouraging student involvement, you can help your students gain a better understanding of personal finance. Incorporating technology into teaching can also enhance the learning experience and make finance more relatable for students. By following these best practices, you can empower your students to make informed financial decisions and pave the way for a brighter financial future.